Discovery Medical Aid 2026 Plans – October NewsletterEstimated Reading Time: 4 Minutes

As we look toward the future, it’s important to stay updated on Discovery Medical Aid 2026 plans.

- October 19, 2025

- Posted by: Informed Healthcare Solutions

- Category: Discovery Health Newsletters

Discovery Medical Aid 2026 Plans & Updates

Discovery Medical Aid 2026 Plans: If you are wondering what Discovery plan to choose for 2026, here is a brief summary of the plan updates compared. Please speak to your advisor if you are unsure of what plan best suits your requirements and budget.

Discovery Contributions Increase 1st April 2026

Contributions will increase on 1st April 2026. The Scheme is projected to end 2025 with a solvency level of 31.6%, well above regulatory requirements, enabling the scheme to defer increase for three months.

Increase percentages are as follows:

- 7.9% for Keycare plans, Coastal plans, Comprehensive plans (including Classic Smart Comprehensive) and the Executive plan.

- 6.9% for Smart plans (excluding Active Smart), Core plans (excluding Coastal), Saver plans (excluding Coastal), and Priority plans.

- No increase for the Active Smart plan.

Discovery charges for a maximum of three children under age 21, except when a child has been placed in the custody of a member, such as foster care, in which case every child on the membership will be counted.

Bizcommunity Article – Discovery Health announces 7.2% increase in 2026 contributions

Smart Saver Series Launches In January 2026

The Smart Saver series launches in January 2026. Members will have risk-funded benefits for their healthcare priorities, flexible benefits to plan for discretionary healthcare, and additional benefits for engaging in their Personal Health Pathways.

Contributions will be R3350 for main member, R2840 per additional adult and R1400 per child for Classic Smart Saver, and R2750, R2350 and R895 for Essential Smart Saver.

The plan includes:

- Unlimited cover for hospital admissions in the Smart Hospital Network, with specialists paid at up to 200% of Discovery Rate in-hospital

- Full cover for Chronic Disease List conditions, for medicine on the formulary, using network pharmacies.

Smart Saver – Risk funded day-to-day benefits per person:

Unlimited GP consultations within Smart network, with a R75 co-payment. One eye test at a network optometrist for R75 per test. One defined dental check-up at any dentist, dental therapist or oral hygienist with a R130 co-payment, covered at 100% of Discovery Rate.

Over-the-counter medication from a network pharmacy covered for R905 per family. Acute medicine prescribed by a Smart GP covered up to R1970 per member and R3300 per family. Contraception covered up to R2600 per female member.

Medical Savings Account: Annual MSA of R2820 for main member, R2388 for additional adults and R1176 for children for the Classic Smart Saver and R2316, R1980 and R756 for Essential Smart Saver.

Smart Saver – Personal Health Fund:

Classic Smart Saver members can earn up to R2500 per adult and R1250 per child (max R10,000 per family) on Personal Health Pathways. Adults can complete challenges to boost this by R2500 per adult (max R10,000 per family).

Essential Smart Saver members can earn up to R1500 per adult and R750 per child (max R6,000 per family) on Personal Health Pathways. Adults can complete challenges to boost this by R1500 per adult (max R6,000 per family).

Supporting Families After Pregnancy In 2026

Nurture At Home

Nurture at Home is a new benefit programme in 2026, designed to support parents whose new-born baby had to spend an extended period of time in a Neonatal Intensive Care Unit (NICU) due to premature birth or medical complications before going home. NICU takes care of vulnerable newborns, but parents need support once the newborn is discharged from NICU.

- A pre-discharge overnight stay in hospital for one of the parents registered on the Scheme.

- Virtual health coaching sessions.

- A virtual and home nurse visit.

- Mental health support.

- Follow-up paediatrician visits.

Available on all Discovery Health Medical Scheme plans except Essential Smart, Essential Dynamic Smart, Active Smart and KeyCare plans. Nuture at Home is subject to the Scheme’s clinical entry criteria, treatment guidelines and managed care protocols.

Perinatal Bereavement Counselling

In 2026, Discovery Health offers members access to perinatal bereavement counselling aimed at supporting families who have suffered the sad loss of pregnancy, experienced a still birth or the loss of their baby immediately post birth. Members will be able to access this support through the Women’s Health Hub integration.

Keycare Enhancements In 2026

Discovery Medical Aid 2026 Plans – Keycare Start

Three new delivery systems will be established in 2026, in Potchefstroom, Welkom and Kimberley. This will increase healthcare delivery systems in South Africa to 24 in 2026.

Care Programmes For Keycare

Members living with a chronic illness are at greater risk of episodes of poor health, including hospital admissions for the treatment of complications related to their illness. Discovery Health Medical Scheme members with chronic illnesses who use a single GP for the coordination of their long term care have a 24% lower hospital admission rate compared with members who use multiple GPs.

The KeyCare series for 2026 is being enhanced to improve healthcare outcomes through coordinated care:

- Members who are registered on the relevant Discovery Health Medical Scheme Care Programme will continue to receive full cover up to 100% of the Discovery Health Rate for all approved basket of care healthcare services for their chronic condition.

- Members who are not registered on a relevant Care Programme will receive cover up to 80% of the Discovery Health Rate from the Chronic Illness Benefit baskets of care, with the co-payment payable by the member.

This applies to members registered for major depression as a Prescribed Minimum Benefit and members registered on the Chronic Illness Benefit for diabetes, hypertension, hyperlipidemia, ischaemic heart disease and HIV.

Oncology Innovation Benefit In 2026

The Oncology Innovation Benefit offers cover for a defined list of non-PMB novel and ultra high-cost cancer medicines such as immunotherapies, monoclonal antibodies and targeted therapies for specified conditions.

3 Changes To The Oncology Innovation Benefit In 2026:

-

- Co-payment on treatment will apply to all molecules and conditions.

- The co-payment on treatment will be 50% for members of the Comprehensive Series.

- Co-payment on treatment will be 30% for members of the Executive Plan.

These co-payments will only be applicable to all new treatment plan approvals from 2026 onwards. Members on existing treatment plans will therefore remain at the same level of co-payment as in 2025.

Discovery Medical Aid 2026 Plans – Surgical Benefit Limits

Cochlear Processors And Bone-anchored Hearing Aids:

- The cochlear processor upgrade limit will be set at R190,000 and applies to all plans except Essential Smart, Essential Dynamic Smart, Active Smart and KeyCare plans where cochlear implants are excluded.

- A limit of R150,000 will apply for bone-anchored hearing aids, with a limit of R78,000 for processor upgrades where a non-network supplier is used. The device will be funded in full when a network supplier is used. The bone-anchored hearing aid and processor upgrades are not covered on the KeyCare series, Essential Smart, Essential Dynamic Smart and Active Smart plans.

- The processor upgrade limit applies once every three years.

Drug Eluting Balloons:

Covered in full when using a network supplier, otherwise a limit of R13,800 will apply per admission on all plans.

Shoulder Joint Prostheses:

Covered in full when using a network supplier; otherwise a limit of between R46,000 and R53,000 will apply, depending on the member’s chosen health plan. On Essential Smart, Essential Dynamic Smart, Active Smart and KeyCare plans joint replacements are covered as PMB only.

Discovery Medical Aid 2026 – Limits, Co-payments, Deductibles And Thresholds

Annual Thresholds will increase in line with relevant contribution increases. Benefit limits, co-payments and deductibles will increase in line with relevant inflation, with the following exceptions remaining constant:

- Personal Health Fund (except for the Executive and Comprehensive plans).

- Oncology Benefit thresholds.

- Specialised Medicine and Technology Benefit.

- International Travel Benefit.

- Overseas Treatment Benefit.

- Surgical and appliance items which include the following limits:

- External medical appliances, including hearing aids and the KeyCare mobility benefit.

- Cardiac stents (except for drug eluting stents on the KeyCare plans).

Discovery Medical Aid 2026 – Personal Health Pathways:

Sleep

In 2026, Personal Health Pathways is becoming even more precise, more personalised, and more rewarding, with the launch of sleep actions and rewards and the introduction of Personal Health Challenges.

The new sleep actions and rewards helps members turn sleep science into daily action. Members can track their Vitality Sleep Score to understand their sleep and will receive a personalised weekly sleep goal to improve their sleep. By achieving these goals, members earn rewards like coffees, smoothies, and Discovery Miles.

The Vitality Sleep Score takes Regularity, Duration and Quality into account, rated out of 100. Personal Health Pathways will give you Next Best Actions such as checking in and completing surveys about your sleep on your Sleep Dashboard. Completing these actions will complete the sleep ring, and earn rewards.

Sleep can be tracked on fitness Devices, mobile phones or with the Oura Smart Ring. Oura will be added to the fitness device benefits offered by Vitality.

Challenges

Certain health actions have a much greater impact on long-term health if they are completed regularly. The impact of those actions are even greater when they become part of every day life, i.e. a healthy habit. These healthy habits include regular exercise, quality sleep, and complying with treatment for a chronic illness.

Personal Health Pathways will launch challenges in 2026, such as:

- Better Health: monitor your blood glucose, monitor your blood pressure.

- Move More: get active, stay active.

- Sleep Well: track your sleep, improve your sleep.

Patterns Of Actions Create Habits.

- Completing the challenges (consistent actions over a 5-10 week period) will encourage members to close the rings in Personal Health Pathways and ultimately lead to healthier living.

- Members earn Discovery Miles or instant rewards for every week they complete, and up to R1500 in their Personal Health Fund for completing the challenge (up to R3,000 per adult per year).

Discovery YouTube Video – Introducing Personal Health Pathways

Maximise Your Personal Health Fund In 2026

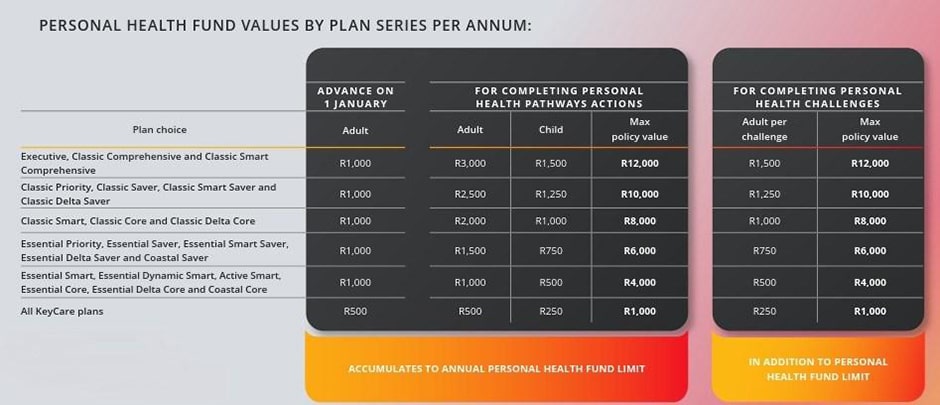

The Discovery Health Medical Scheme Personal Health Fund will be enhanced in 2026.

- Complete challenges to earn extra funds for your Personal Health Fund, with up to R1500 per challenge.

- Each Personal Health Pathway action completed can earn R500 for your Personal Health Fund.

- Every Discovery Health adult member who has activated Personal Health Pathways, enabled physical activity and sleep tracking on their phone or device, and completed their Health Check in the previous year, will start 2026 with a Personal Health Fund balance of R1000.

Annual Limits Vary According to the Chosen Health Plan.

Discovery Medical Aid 2026 Plans – 5 Ways To Maximise Your Funds:

-

- Activate Personal Health Pathways and complete your Health Check before the end of the year.

- Complete your recommended actions until you reach your limit.

- Make sure all adults and children on your policy engage with the

- Programme and complete at least two actions.

- Complete your Personal Health Challenges and earn additional funds.

Getting Active With Vitality In 2026

Your Vitality Status can earn you more free fitness workouts. In 2025, all Vitality members have access to 2 workouts per month. In 2026, members on Blue Status will have 2 visits, Bronze and Silver 4, and Gold and Diamond 8 per month. You need to activate DiscoveryPay to book your workouts through Vitality Fitness.

You can sign up for the Discovery Account with Discovery Bank, with zero monthly fees. Then use your free workouts at facilities within the Vitality Fitness Network. When you use your free workout to make a booking, you get an access pass.

In 2026, you will be able to use your free workouts to book classes at select Virgin Active clubs, and Bookamat (yoga and pilates studios) has also been added to available classes.

Vitality Fitness Device Benefit In 2026

In 2026, Vitality members will be able to fully fund a Garmin device by achieveing their weekly Vitality Active Rewards exercise goals over a 24-month period. Members must have a qualifying Discovery Bank credit card or suite account. Purchases are from Totalsports or Sportsman’s Warehouse, on devices valued up to R8000.

An activation fee of R799 applies. The maximum monthly penalty for not reaching your exercise goals is R334 per month. If you reach 0 goals in the month you pay 100% penaly (max R334), 1-2 goals 75% (max R251), 3 goals 50% (max R167) and 4+ goals 0%.

In addition to the fully funded option, all Vitality Premium and Vitality Active members will have access to an always-on discount of up to 25% on Garmin devices, from Totalsports or Sportsman’s Warehouse.

Discovery Medical Aid 2026 Plans

Medical Aid Quotes | Gap Cover Quotes | Life Insurance | Vitality

Disclaimer: The information and opinions in this document have been recorded and arrived at in good faith and from sources believed to be reliable, but no representation or warranty, expressed or implied, is made to their accuracy, completeness or correctness. The information is provided for information purposes only and should not be construed as the rendering of advice. Informed Healthcare Solutions accordingly accepts no liability whatsoever for any direct, indirect or consequential loss arising from the use of this document or its contents. IHS is a licensed financial service provider: FSP # 12239